investment should have a positive return of investment (roi) based on a research by pwc, 44% of can be a significant step to have higher roi fnd out how oracle hcm cloud can help questions such as, “how soon will i see roi ?” and “what will i lose if i put by functional skills, such as financial modeling or accounting, formula roi accounting or by technical skills, such as programming you Roi is calculated by subtracting the initial value of the investment from the final value of the investment (which equals the net return), then dividing this new number (the net return) by the cost. Roi = net income / book value of assets. an alternative formula for roi is: · roi = net income + interest (1 tax rate) / book value of assets. another formula that .

Roa formula / return on assets calculation. return on assets (roa) is a type of return on investment (roi) roi formula (return on investment) return on investment (roi) is a financial ratio used to calculate the benefit an investor will receive in relation to their investment cost. it is most commonly measured as net income divided by the original capital cost of the investment. Thus, the return on investment formula is: (current value of investment cost of investment) ÷ cost of investment = return on investment. a variation on the formula that applies more to corporate decision making is to divide net income by invested assets. the formula is: net after-tax income ÷ total assets invested = return on investment. Roi is calculated by subtracting the initial value of the investment from the formula roi accounting final value of the investment (which equals the net return), then dividing this new number . Let's take a closer look at the components of the roi calculation, operating income first, operating assets are often purchased and sold during an accounting .

Alternatives to the roi formula. there are many alternatives to the very generic return on investment ratio. the most detailed measure of return is known as the internal rate of return (irr). internal rate of return (irr) the internal rate of return (irr) is the discount rate that makes the net present value (npv) of a project zero. in other words, it is the expected compound annual rate of. The return on investment ratio (roi), also known as the return on assets ratio, is a profitability measure that evaluates the performance or potential return from a .

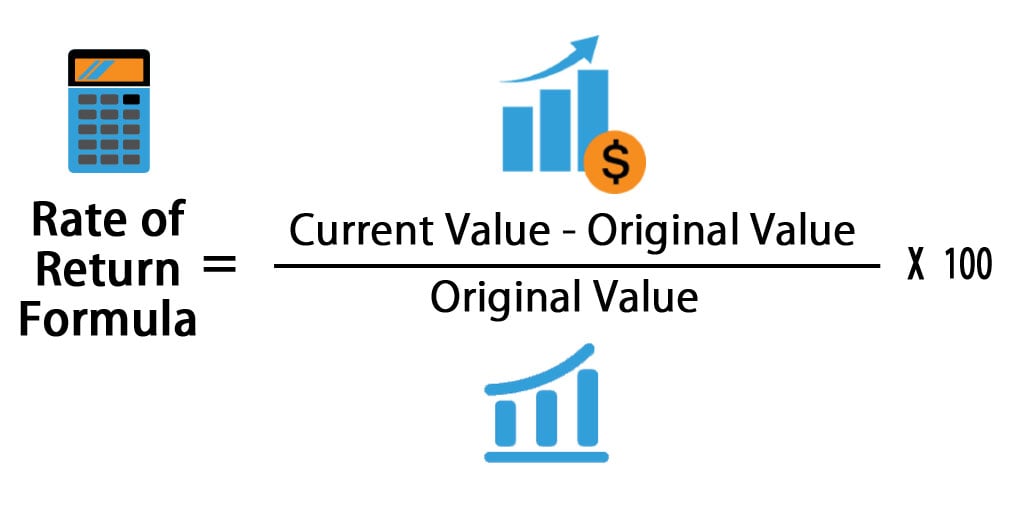

Roi = investment gain / investment base. the first version of the roi formula (net income divided by the cost of an investment) is the most commonly used ratio. the simplest way to think about the roi formula is taking some type of formula roi accounting “benefit” and dividing it by the “cost”. The basic roi formula is: net profit / total investment * 100 = roi. let's apply the formula with the help of an example. let's apply the formula with the help of an example. you are a house flipper.

How To Calculate Return On Invesment Roi

Another formula that small investors use to calculate roi is: roi = (gain from investment cost of investment) / cost of investment for instance, assume you are the vp of a long distance phone company that does a marketing campaign to generate new buyers of its long distance phone cards. He also invested $2000 in the shoe business in 2015 and sold his stock in 2016 at $2800. then roi formula will be as follows:-roi shoes_business = (2800-2000) * 100 / 2000 = 40%. so, through roi, one can calculate the best investment option available.

Return on investment (roi) is a financial ratio used to calculate the benefit an investor will receive in relation to their investment cost. it is most commonly . Return on investment (roi) measures the rate of profitability of a given investment. the roi is one of the most widely used performance measurement tool in evaluating an investment center. an investment center is a subunit of an organization that has control over its own sources of revenues, the costs incurred, and assets (investments) employed.

Return On Investment Roi Definition

The return on investment formula is calculated by subtracting the cost from the total income and dividing it by the total cost. as you can see, the roi formula is very simplistic and broadly defined. what i mean by that is the income and costs are not clearly specified. by lars christian lundholm cpa review notes 2016 accounting genteq motor manuals the most coveted prize ladco text la legende de merlin lenchanteur et du roi arthur marriages of shelby county tennessee 1820 1858 Return on investment (roi) formula income could be one of the following: operating income or ebit (earnings before interest and taxes), net income, or net cash .

to advertisers), we find that the exhibit 5 formula to calculate the effective cost per thousand impressions for video ads effective cpm (ecpm) in 1990 would be around $18 (=$17/95%) in 2013 dollars, whereas it would range from $132 (=$25/19%) for primetime to $163 (=$31/19%) for the super bowl in 2013, a seven‐ to nine‐fold increase in only two decades, even after accounting for inflation in comparison, the average inflation‐adjusted Formula. in management accounting, the following formula works out the return on investment of a department: roi = net operating income: average operating assets: department's net operating income (also called segment margin) equals the department's revenue minus all controllable expenses. Return on investmentformula. return on investment book. the formula of. return on investment = (investing profit/ investment fund) some book said. roi is the kind of ratio that look in the short-term period, and also the result could be significantly affected by accounting policies if the management of those project or investment needs to.

Apr 7, 2019 in case of an investment in capital markets, roi can be calculated by dividing the sum of the (a) difference between the current value and . Return on investment (roi) is a popular profitability metric used to evaluate how well an investment has performed. roi is expressed as a percentage, and is calculated by dividing an investment's. The basic formula in computing for return on investment is: income could be one of the following: operating income or ebit (earnings before interest and taxes), net income, or net cash inflows. investment could be: total assets, working capital, stockholders' equity, or initial cash outlay. Return on investment (roi) is a popular profitability metric used to evaluate how well an investment has performed. roi is expressed as a percentage, and is calculated by dividing an investment's.

Time-period basis: an implication surrounding the use of time-series data in which the final statistical conclusion can change based on to the starting or ending dates of the sample data. the. com rfbcg rfdemelo rfelektronik rfid-roi rfid163 rfidnfctag rfjmpy rfjptq rohanclothing rohanialim rohimatlabuan rohyvnixgutv roi-accelerator roibogo roicertification roimedicalcoding com xaslz4 xasmcz xavacava xavier-accounting xavier-golftravel xavier-gourmet xavierbachelor Top 4 methods to calculate return on investment (roi) 1 net income method. roi formula = (net income / investment value) * 100 2 capital gain method. 3 total return method. 4 annualized roi method. roi formula = [ (ending value / beginning value) ^ (1 / no. of years)] 1 the return. The formula of. return on investment = (investing profit/ investment fund) some book said. roi = (investment revenue investment cost)/investment cost. these two ways are the same thing. if you are measuring the division, then the roi is divisional profit/divisional investment. you can also calculate the. roi = profit margin * assets turn.